Carbon Pricing in Action

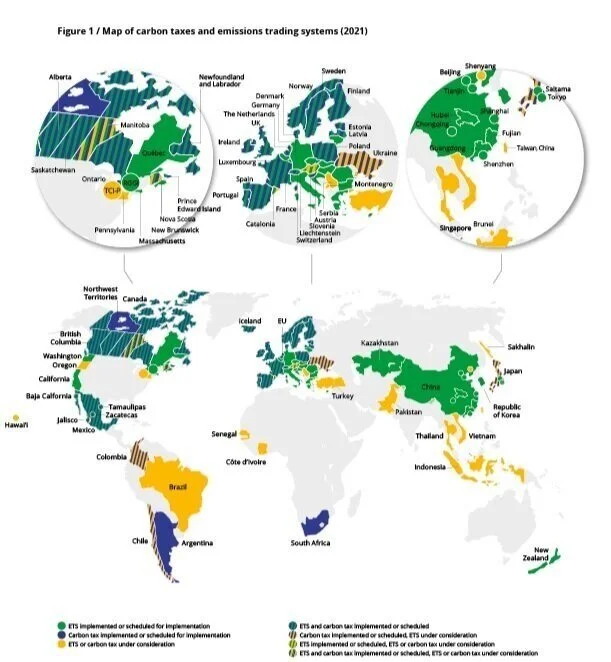

As of May 2021, 37 national and 27 subnational jurisdictions are putting a price on carbon.

Summary of regional, national and subnational carbon pricing initiatives implemented, scheduled for implementation and under consideration (ETS and carbon tax)

Map from the State and Trends of Carbon Pricing 2021 Report